Revenues received by the Perry County Board of Developmental Disabilities (PCBDD) come from a combination of local, state, and federal sources. All services offered by PCBDD are provided at no cost, except as required by state rule.

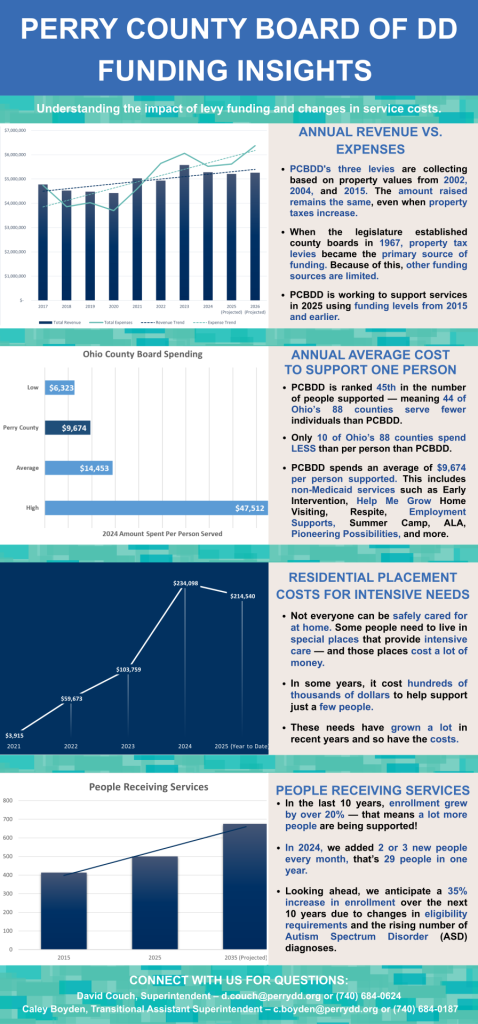

The majority of PCBDD’s operating revenue is provided by local funding sources. Property tax levies supported by Perry County voters are PCBDD’s single largest revenue source and account for approximately 68% of total revenue. Levy funding can be used to support all programs and services. TANF, provided by Perry County Department of Job & Family Services, is used to support programs that are provided to children, like The Academy for Leadership Abilities®, summer camp, and home-based services for children and their families.

A small amount of state funding is provided by the Ohio Department of Developmental Disabilities (DODD) and Ohio Department of Children and Youth. State rules and regulations govern the use of these funds.

Federal funding primarily comes from Medicaid programs and is PCBDD’s second largest funding source. The use of Medicaid funds is also governed by various rules and regulations.

The Perry County Board of Developmental Disabilities strives for the best stewardship of our resources to ensure long-term sustainability of programs and services.